Compensation and Benefits

Compensation and benefits refer to the monetary and non-monetary rewards provided by an employer to employees in exchange for their work, including salaries, bonuses, insurance, and other perks.

Compensation and Benefits, often abbreviated as "C&B," is not merely about salaries and perks; it encompasses a multifaceted spectrum of rewards, incentives, and policies designed to nurture a harmonious relationship between employers and employees. In an era where the workforce is diverse, dynamic, and discerning, a well-crafted Compensation and Benefits program can be the linchpin that sets an organization apart, ensuring that it not only attracts top talent but also nurtures a culture of engagement and productivity.

Let's delve into the intricacies of compensation and benefits and unravel the world of employee rewards and satisfaction.

What is Compensation and Benefits?

Compensation and Benefits is a comprehensive framework employed by organizations to reward and incentivize their employees for their work, dedication, and contributions. It encompasses both financial and non-financial elements that together form the total value employees receive for their employment.

Components of Compensation and Benefits

Here are the key components of compensation and benefits:

- Base Salary: This is the fixed amount of money an employee receives regularly, usually in the form of hourly wages or an annual salary. Base salary is often determined by factors such as job role, experience, education, and market rates.

- Variable Pay: Also known as performance-based pay or incentives, variable pay includes bonuses, commissions, profit-sharing, or other forms of compensation that vary based on an employee's performance or the company's financial performance.

- Benefits: Employee benefits are non-wage compensation provided to employees in addition to their base salary. Common benefits include:

- Healthcare: Medical, dental, and vision insurance.

- Retirement Plans: Such as 401(k) or pension plans.

- Paid Time Off: Including vacation days, sick leave, and holidays.

- Life Insurance: Coverage for employees and their beneficiaries.

- Disability Insurance: Provides income protection in case of disability.

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): Allow employees to set aside pre-tax dollars for healthcare expenses.

- Wellness Programs: Fitness memberships, counseling services, or other health-related benefits.

- Tuition Reimbursement: Assistance with education or professional development costs.

- Childcare Assistance: Subsidies or facilities for childcare.

- Transportation Benefits: Parking passes, public transit subsidies, or commuter assistance.

- Employee Assistance Programs (EAPs): Mental health counseling and support services.

- Stock Options or Equity Grants: Ownership in the company through stocks or stock options.

- Employee Discounts: Discounts on company products or services.

- Perks and Allowances: These are additional non-cash benefits or allowances provided to employees. They can include items like company cars, cell phone allowances, meal allowances, or gym memberships.

- Long-Term Incentives: These are rewards designed to encourage employees to stay with the company over the long term. They often take the form of stock options, restricted stock units (RSUs), or performance-based equity grants.

- Severance Packages: In the event of layoffs, job terminations, or retirement, severance packages may include financial compensation, extended benefits, or outplacement services to help employees transition.

Why is Compensation and Benefits Important?

Compensation and Benefits (C&B) are critically important in the realm of human resource management and organizational success for several key reasons:

- Attraction and Retention of Talent: A competitive C&B package is a powerful tool for attracting top talent to your organization and retaining existing skilled employees. In a competitive job market, potential employees often consider not only their base salary but also the overall compensation and benefits package when deciding where to work.

- Motivation and Performance: Compensation, including bonuses and incentives, can motivate employees to perform at their best. When employees see a direct link between their efforts and their earnings, they are more likely to be engaged and committed to achieving their goals and those of the organization.

- Job Satisfaction and Morale: Offering a comprehensive benefits package, such as health insurance, retirement plans, and paid time off, contributes to employee well-being and job satisfaction. When employees feel that their basic needs and personal interests are taken into account, they are generally happier and more satisfied in their roles.

- Competitive Advantage: A well-structured C&B strategy can give your organization a competitive advantage in the job market. It can differentiate your company from competitors and attract high-caliber candidates who may be seeking not only financial rewards but also a supportive work environment.

- Employee Engagement and Loyalty: Employees who feel valued through their compensation and benefits are more likely to be engaged in their work and loyal to their employer. High employee engagement can lead to increased productivity, lower turnover rates, and a more positive workplace culture.

Types of Compensation and Benefits

Compensation and benefits can be categorized into two main groups based on whether they have a monetary value or not:

Benefits with a Monetary Value

- Base Salary: The fixed amount of money employees receive regularly, usually as an hourly wage or annual salary.

- Bonuses: Additional financial rewards provided to employees based on performance, company profits, or other criteria.

- Commissions: Compensation based on a percentage of sales or revenue generated by an employee.

- Stock Options: The right to purchase company stock at a predetermined price, potentially allowing employees to benefit from the increase in stock value.

- Profit-Sharing Plans: A portion of the company's profits is distributed among employees as a bonus.

- 401(k) Matching: Employers contribute a percentage of an employee's salary to their retirement savings plan (401(k)) to match the employee's contributions.

- Health Insurance Premiums: Employers may subsidize or fully cover the cost of employees' health insurance premiums.

- Dental and Vision Insurance: Similar to health insurance, employers may provide dental and vision insurance coverage, often with a contribution towards premiums.

- Life Insurance: Employers may offer life insurance coverage for employees with the company covering some or all of the premium costs.

- Transportation Subsidies: Financial assistance for commuting expenses, such as public transportation or parking.

- Cell Phone or Internet Allowance: Monetary allowances to cover the cost of employees' personal cell phone or internet expenses, often for work-related use.

Benefits with No Monetary Value:

- Paid Time Off (PTO): While PTO provides time away from work with pay, it doesn't have a direct monetary value because it's time-based rather than cash-based.

- Holidays: Paid holidays, such as Christmas or Independence Day, provide time off but don't have a direct monetary value beyond the regular salary or wage.

- Employee Assistance Programs (EAPs): EAPs offer counseling and support services, which are valuable but not directly monetized.

- Recognition and Awards: These include certificates, plaques, and public acknowledgment for outstanding performance, which hold sentimental value but not a monetary one.

- Wellness Programs: While wellness programs promote health and well-being, they are not typically tied to direct financial compensation.

- Flexible Work Arrangements: Options like remote work or flexible hours offer employees greater work-life balance but don't have a specific monetary value.

- Career Development Opportunities: Providing access to training, mentorship, or advancement opportunities can be valuable but isn't a direct monetary benefit.

- Employee Discounts: Discounts on company products or services can save employees money but aren't cash benefits.

Types of Compensation

Compensation in the workplace can be categorized into two main types: direct compensation and indirect compensation. These two categories encompass various forms of rewards and benefits that organizations offer to their employees. Here's a breakdown of each type:

- Direct Compensation

Direct compensation refers to the monetary rewards and payments that employees receive for their work. It includes:

- Base Salary/Wages: This is the fixed amount of money employees receive for their regular work hours or as an annual salary. It serves as the foundation of an employee's compensation package.

- Bonuses: Bonuses are typically performance-based and can come in various forms, such as annual performance bonuses, signing bonuses, or project-based bonuses.

- Commissions: Commonly used in sales roles, commissions are a percentage of sales revenue or profits earned by an employee. Salespeople often receive commissions in addition to their base salary.

- Overtime Pay: Employees who work beyond their regular hours may receive overtime pay, which is usually a higher hourly rate than their regular wage.

- Merit Increases: These are salary increases given to employees based on their individual performance, skills, and contributions to the organization.

- Indirect Compensation

Indirect compensation, also known as benefits or perks, includes non-monetary rewards and offerings that enhance an employee's overall compensation package. Indirect compensation can vary widely among organizations and may include:

- Health Insurance: Many employers provide health insurance coverage for employees and their families. This can include medical, dental, and vision plans.

- Retirement Benefits: Retirement benefits often include employer-contributed plans like 401(k)s, pensions, or other retirement savings programs.

- Paid Time Off (PTO): PTO includes paid vacation days, holidays, sick leave, and personal days, which allow employees to take time off with pay.

- Flexible Work Arrangements: Employers may offer flexible work options like telecommuting, flextime, or compressed workweeks to improve work-life balance.

- Education and Training: Some organizations invest in their employees' professional development by providing tuition assistance, training programs, or access to online courses.

- Employee Assistance Programs (EAPs): EAPs offer counseling and support services to help employees deal with personal and work-related issues.

- Stock Options and Equity Grants: In some companies, employees may receive stock options or equity grants as part of their compensation package, allowing them to share in the company's success.

- Wellness Programs: These programs promote employee health and well-being and can include fitness memberships, wellness incentives, and health screenings.

- Childcare and Family Support: Some employers provide childcare assistance or family-friendly benefits to help employees balance work and family responsibilities.

Differences between Compensation and Benefits

| Aspect | Compensation | Benefits |

| Definition | Monetary rewards are provided to employees in exchange for their work. | Non-monetary perks and offerings are provided to employees in addition to their compensation. |

| Nature | Typically includes cash payments, such as salaries, bonuses, and commissions. | Includes non-cash offerings like health insurance, PTO, and retirement plans. |

| Form | Direct cash payments and incentives. | Indirect forms of compensation, often in the form of services or coverage. |

| Purpose | Rewarding employees for their work and performance. | Enhancing employee well-being, work-life balance, and overall job satisfaction. |

| Taxation | Generally subject to income tax and payroll taxes. | Benefits may have tax advantages, such as pre-tax deductions for retirement contributions or healthcare expenses. |

| Examples |

|

|

| Measured and Monitored | Easily quantifiable and measured in monetary terms. | Evaluated in terms of usage, employee satisfaction, and compliance with legal requirements. |

| Short-Term vs. Long-Term | Often includes short-term incentives and rewards. | Includes both short-term (e.g., PTO) and long-term benefits (e.g., retirement plans). |

| Direct Impact on Paycheck | Directly affects an employee's regular paycheck. | May not be reflected in the regular paycheck but provided as separate benefits. |

| Motivation and Retention | Motivates employees through financial incentives. | Attracts and retains employees by enhancing their quality of life and job security. |

How do HR Departments calculate compensation and benefits?

HR departments calculate compensation and benefits by considering a variety of factors, including:

- The job title and level of responsibility: More complex and demanding jobs typically command higher salaries.

- The employee's experience and skills: Employees with more experience and skills are typically paid more.

- The company's size and industry: Companies in certain industries, such as technology and finance, tend to pay their employees higher salaries.

- The cost of living in the area: Employees who live in areas with a high cost of living typically need to be paid more to maintain their standard of living.

- The employee's performance: Employees who consistently meet or exceed expectations may be eligible for salary increases or bonuses.

In addition to base salary, employees may also receive a variety of benefits, such as health insurance, retirement savings plans, paid time off, and tuition reimbursement. The specific benefits that are offered will vary from company to company.

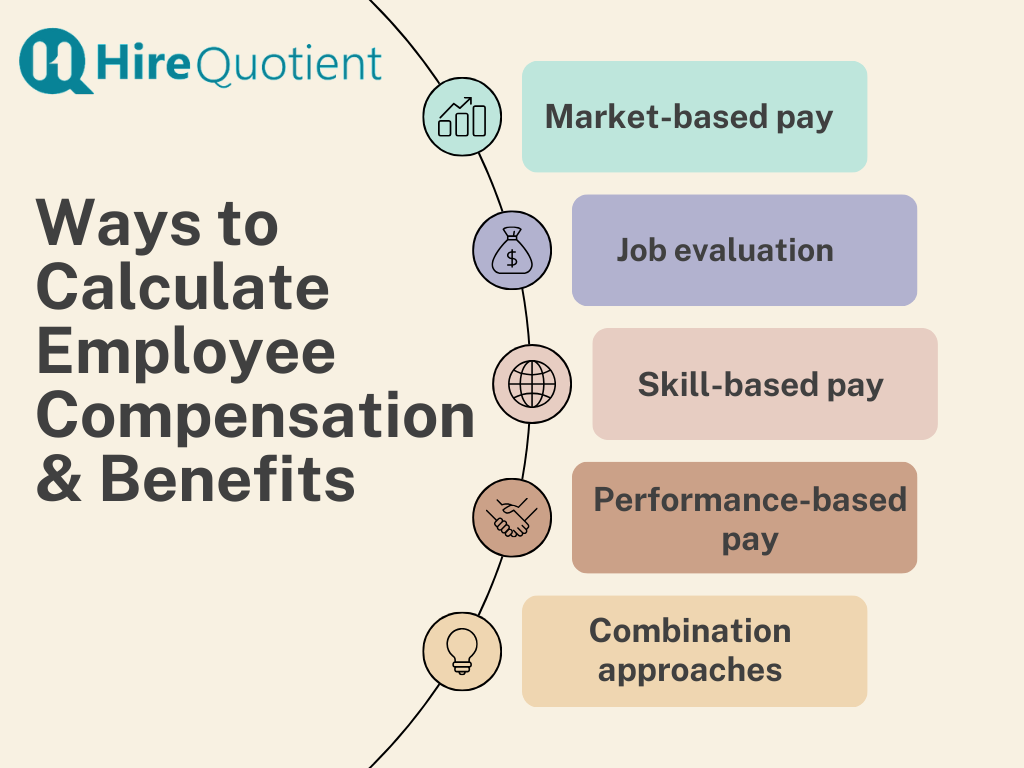

Here are some of the different ways of calculating employee compensation and benefits:

- Market-based pay: This is the most common approach to compensation. It involves comparing the salaries of similar positions in other companies in the same industry and geographic area. This information can be obtained from salary surveys, which are conducted by independent companies.

- Job evaluation: This approach is less common than market-based pay, but it can be useful for companies that have a variety of job titles and levels of responsibility. Job evaluation involves comparing the different jobs within a company to determine their relative worth. This can be done by using a variety of factors, such as the skills and knowledge required for the job, the level of responsibility, and the difficulty of the work.

- Skill-based pay: This approach is becoming increasingly popular, especially in knowledge-based industries. Skill-based pay rewards employees for their skills and knowledge, regardless of their job title or level of responsibility. This can be done by giving employees pay increases or bonuses for acquiring new skills or completing training programs.

- Performance-based pay: This approach is based on the idea that employees should be rewarded for their performance. Performance-based pay can be linked to individual, team, or company goals. It can also be based on factors such as productivity, quality, and customer satisfaction.

- Combination approaches: Many companies use a combination of these approaches to calculate compensation and benefits. For example, a company might use market-based pay as a starting point, but then adjust salaries based on job evaluation or performance.

Models that explain Compensation and Benefits

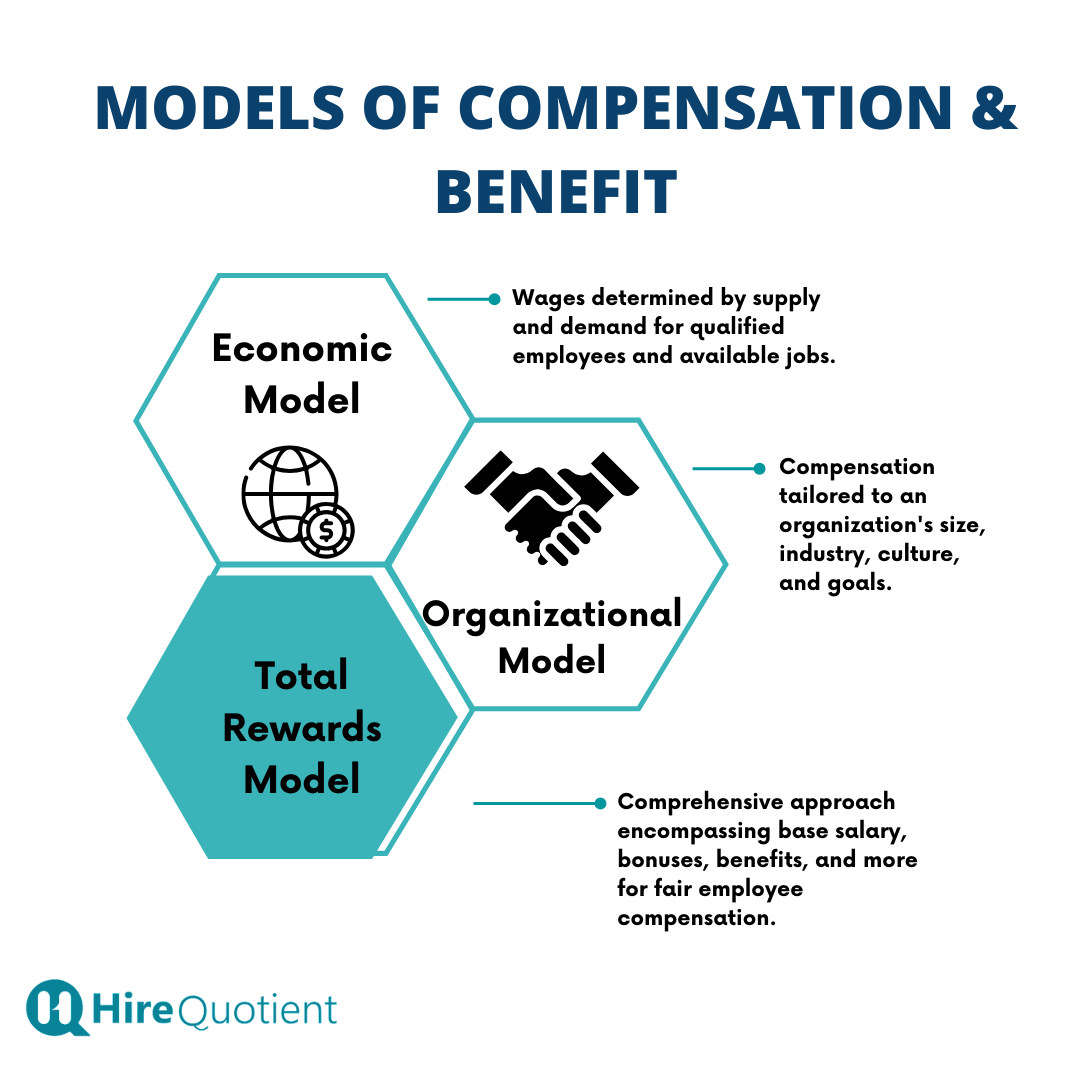

- Economic Model: The economic model of compensation is based on the idea of supply and demand. In this model, the wages of an employee are determined by the number of people who are qualified to do the job and the number of jobs available. If there are more people qualified to do the job than there are jobs available, then wages will be lower. If there are fewer people qualified to do the job than there are jobs available, then wages will be higher.

- Organizational Model: The organizational model of compensation takes into account the factors that are specific to a particular organization. These factors can include the company's size, industry, and culture. The company's goals and objectives are also important factors in determining compensation. For example, a company that is trying to attract and retain top talent may offer higher salaries than a company that is not.

- Total Rewards Model: The total rewards model is a comprehensive approach to compensation that considers all of the factors that contribute to an employee's overall compensation package. In addition to base salary, this can include bonuses, commissions, benefits, and other forms of compensation. The total rewards model is designed to ensure that employees are fairly compensated for their contributions to the organization.

Difference Between Payroll and Compensation

| Feature | Payroll | Compensation |

| Definition | The process of calculating and distributing employee wages, salaries, and other payments | All of the forms of pay and benefits that an employee receives from an employer |

| Components | Wages, salaries, commissions, bonuses, overtime pay, deductions, taxes | Base salary, bonuses, commissions, benefits, perks |

| Scope | Narrower | Broader |

| Purpose | To calculate and distribute employee payments | To attract, retain, and motivate employees |

Conclusion

To effectively manage compensation and benefits, organizations must strike a balance between competitive pay and benefits packages that align with their industry and organizational goals while also adhering to legal and ethical standards. Additionally, the evolving nature of work, changing demographics, and the rise of remote and flexible work arrangements have led to the need for adaptability and innovation in compensation and benefits practices.