What does Exempt Employee Mean?

Published on May 1st, 2023

As recruiters and hiring managers, it is important to understand the legal distinctions that affect employees and benefits within a company. One of the key classifications you’ll come across when hiring new employees is that of an "exempt employee." This classification directly impacts your organization's compliance with labor laws, employee benefits, and compensation practices.

An exempt employee does not qualify for overtime pay, while a non-exempt employee is entitled to overtime pay by law. While this exempt employees vs. non-exempt employees may seem simple, the criteria involved in determining an employee’s exemption status can be quite complex. It is crucial to familiarize yourself with what an exempt employee is, how they differ from non-exempt employees, and what this classification means for your organization.

In this blog post, we’ll provide you with an in-depth overview of exempt employee classification, how it may impact your company, and why understanding this difference matters for effective and compliant hiring.

Definition of an Exempt Employee

First, let's start with the definition of an exempt employee. In simple terms, an exempt employee is a type of employee who is exempt from overtime pay and certain labor protections under the Fair Labor Standards Act (FLSA). The U.S. Department of Labor classifies exempt employees as those who are not entitled to the minimum wage and overtime pay requirements set by the FLSA. This means that employers are not required to pay exempt employees overtime for working more than 40 hours per week.

However, it’s important to note that being exempt does not mean employees aren’t entitled to any compensation beyond their base salary. Employers are still required to comply with other labor laws such as those governing sick leave, maternity leave, and disability protections.

To determine whether an employee qualifies as exempt under the Fair Labor Standards Act (FLSA), three primary tests must be applied: the Salary Basis Test, the Salary Level Test, and the Duties Test. Let's understand each of these tests in detail -

The Tests That Define Exempt Status

Salary Basis Test

According to the FLSA, employees who receive a predetermined salary that does not fluctuate based on the quality or quantity of work performed are considered exempt. The salary must be at least $455 per week. However, it's important to note that not all employees who are salaried are automatically exempt; the nature of their work and their job duties must also be taken into account.

Also read: How Many Hours can a Salaried Exempt Employee be Forced to Work?

Salary Level Test

In addition to the salary basis test, the FLSA states that exempt employees must also receive a salary equal to or greater than the minimum threshold set by the Department of Labor. This amount has changed over the years and is currently set at $684 per week or $35,568 per year.

Duties Test

Finally—and perhaps most importantly—in order to be classified as exempt, an employee must meet certain job requirements in terms of their primary duties. These duties must fall into one of the following three categories:

- Executive Duties – Employees who manage a company or a department of a company, regularly direct the work of two or more employees, and have hiring and firing responsibilities are considered exempt.

- Professional Duties – Employees who have specialized knowledge in a particular field, such as law, medicine, or engineering, and who perform their duties in accordance with that knowledge, are considered exempt.

- Administrative Duties – Employees whose primary duties involve administrative or office work, such as payroll, records, management, and human resources, are considered exempt.

Under the FLSA, these categories broadly include employees who manage others, perform office or non-manual work related to business operations, or carry out specialized work requiring advanced knowledge. Learning and implementing these tests accurately is essential to ensure compliance with labor laws and to avoid costly misclassifications.

Exempt vs. Non-Exempt: The Key Differences

The key difference between exempt and non-exempt employees, from an employer's perspective, lies in their entitlement to overtime pay and labor protections. The key differences between Exempt and Non-exempt employees are -

| Category | Exempt Employees | Non-Exempt Employees |

| Overtime Pay | Not entitled to overtime pay (unless contractually stated) | Entitled to overtime pay for hours worked beyond 40 in a week |

| Overtime Pay | Not entitled to overtime pay (unless contractually stated) | Entitled to overtime pay for hours worked beyond 40 in a week |

Labor Protections

| Not entitled to meal/rest breaks or minimum wage under FLSA | Entitled to labor protections such as minimum wage, meal, and rest breaks |

Job Duties

| Must perform executive, administrative, or professional duties | May perform a wide range of duties, not limited to exempt-level responsibilities |

| Independent Decision-Making | Expected to exercise discretion and independent judgment | Generally follow structured guidelines and supervision |

| FLSA Coverage | Exempt from FLSA minimum wage and overtime provisions | Covered under FLSA minimum wage and overtime provisions |

| FLSA Coverage | Exempt from FLSA minimum wage and overtime provisions | Covered under FLSA minimum wage and overtime provisions |

Understanding these distinctions is crucial for employers to stay compliant and for recruiters to structure roles and compensation accurately.

Why Exempt Status Matters for Employers?

Classifying employees as exempt or non-exempt carries significant implications for an organization’s compensation structure, compliance practices, and legal responsibilities.

Exempt employees typically receive higher salaries or bonuses in place of overtime pay, which can raise payroll costs. Additionally, some exempt roles come with specific titles that may qualify for unique benefits or fall under additional employment laws. This makes it essential for employers to apply the exempt status accurately.

Misclassifying a non-exempt employee as exempt can lead to serious consequences, including legal claims, back pay for unpaid overtime, and penalties for violating labor laws. For example, the employer could be liable for retroactive compensation if a non-exempt employee works more than 40 hours a week and isn’t paid overtime due to incorrect classification.

Understanding the difference between exempt and non-exempt status is crucial for recruiters and hiring managers when structuring job offers, setting salaries, and managing compliance. This knowledge helps ensure the fair treatment of employees and protects the organization from legal and financial risks.

How EasySource Helps Recruiters Find Exempt Talent?

Sourcing exempt talent requires precision, speed, and personalization. EasySource, powered by HireQuotient, is redefining how recruiters approach this challenge with the world’s first fully automated talent sourcing platform.

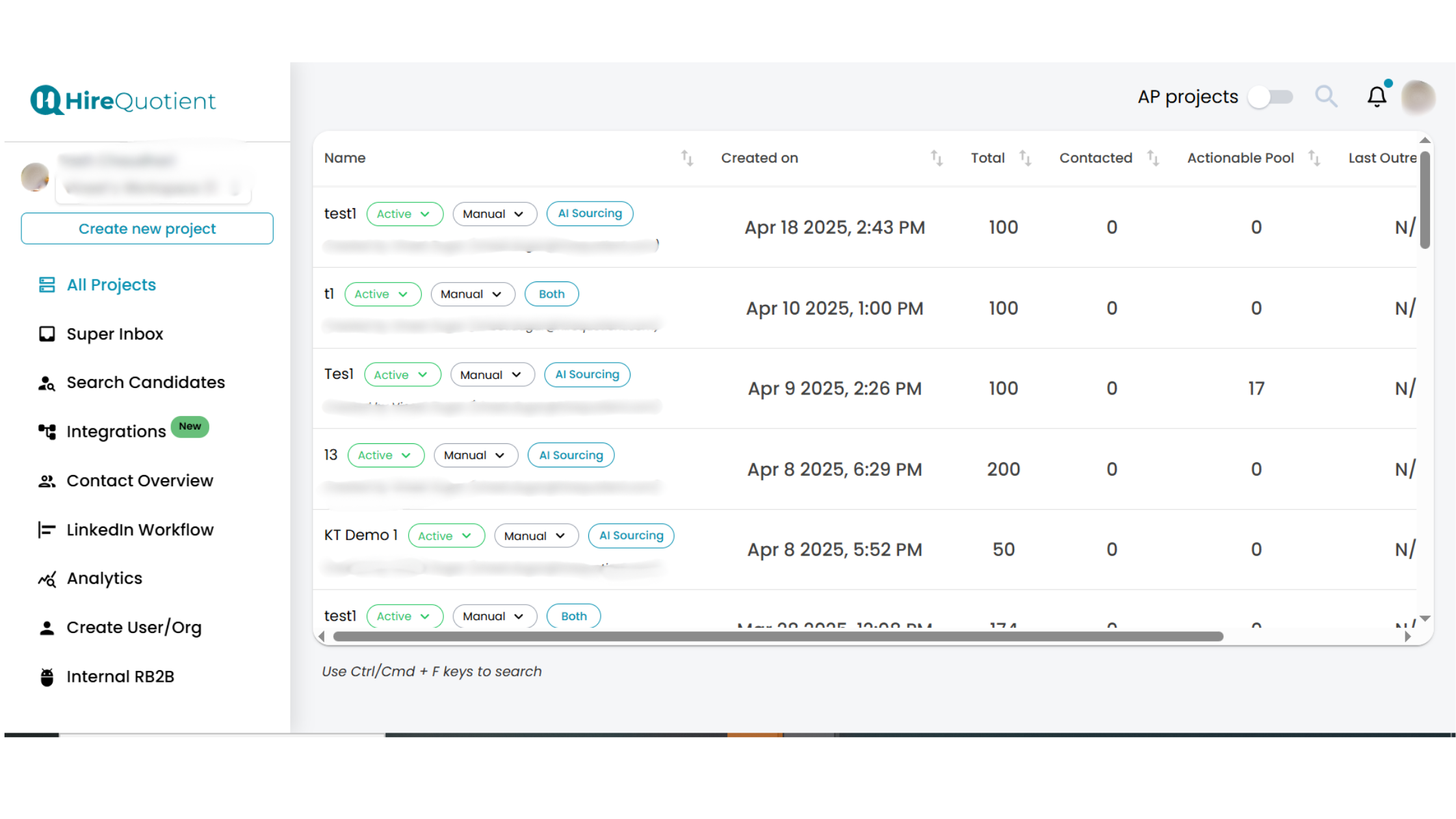

1. Automation at Its Core

The EasySource interface empowers recruiters to create, manage, and track multiple sourcing projects simultaneously. With just a few clicks, users can:

- Initiate new projects via the "Create new project" button.

- Access detailed project views, showing candidate pools, contacted candidates, and actionable insights.

- Toggle between AI Sourcing, Manual, or Both methods—giving recruiters flexibility in how they want to operate.

The streamlined UX ensures recruiters can scale their outreach without the bottlenecks of traditional sourcing platforms.

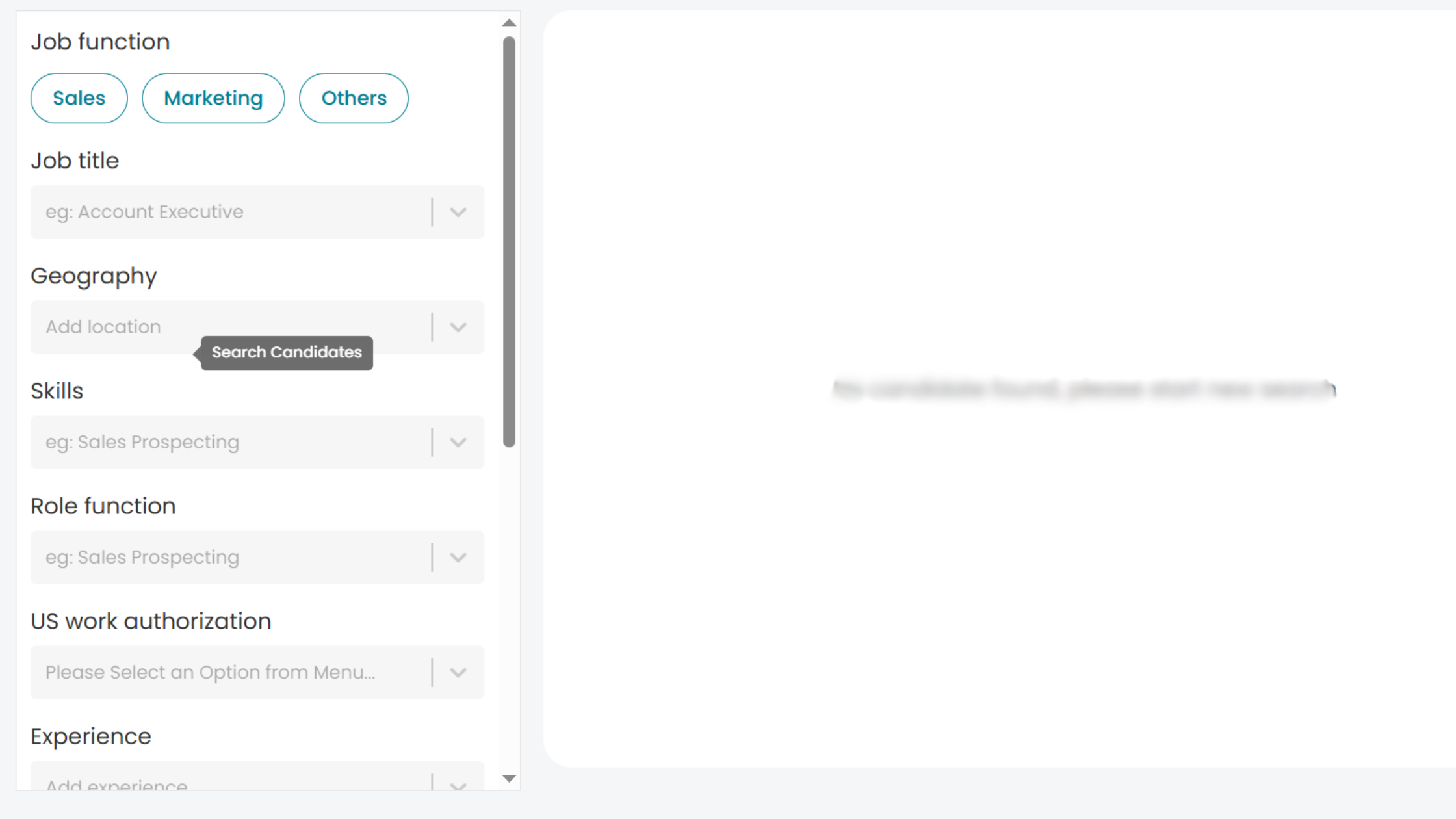

2. AI-Powered Filtering for Precision Targeting

EasySource is built on robust AI algorithms that enable recruiters to filter talent based on key parameters such as:

- Job title

- Location

- Skills

- Education

- industry

- Years of Experience

- US Work Authorization

This AI-based filtering mechanism helps hiring teams zero in on exempt professionals who precisely match the role requirements, eliminating irrelevant profiles early in the funnel.

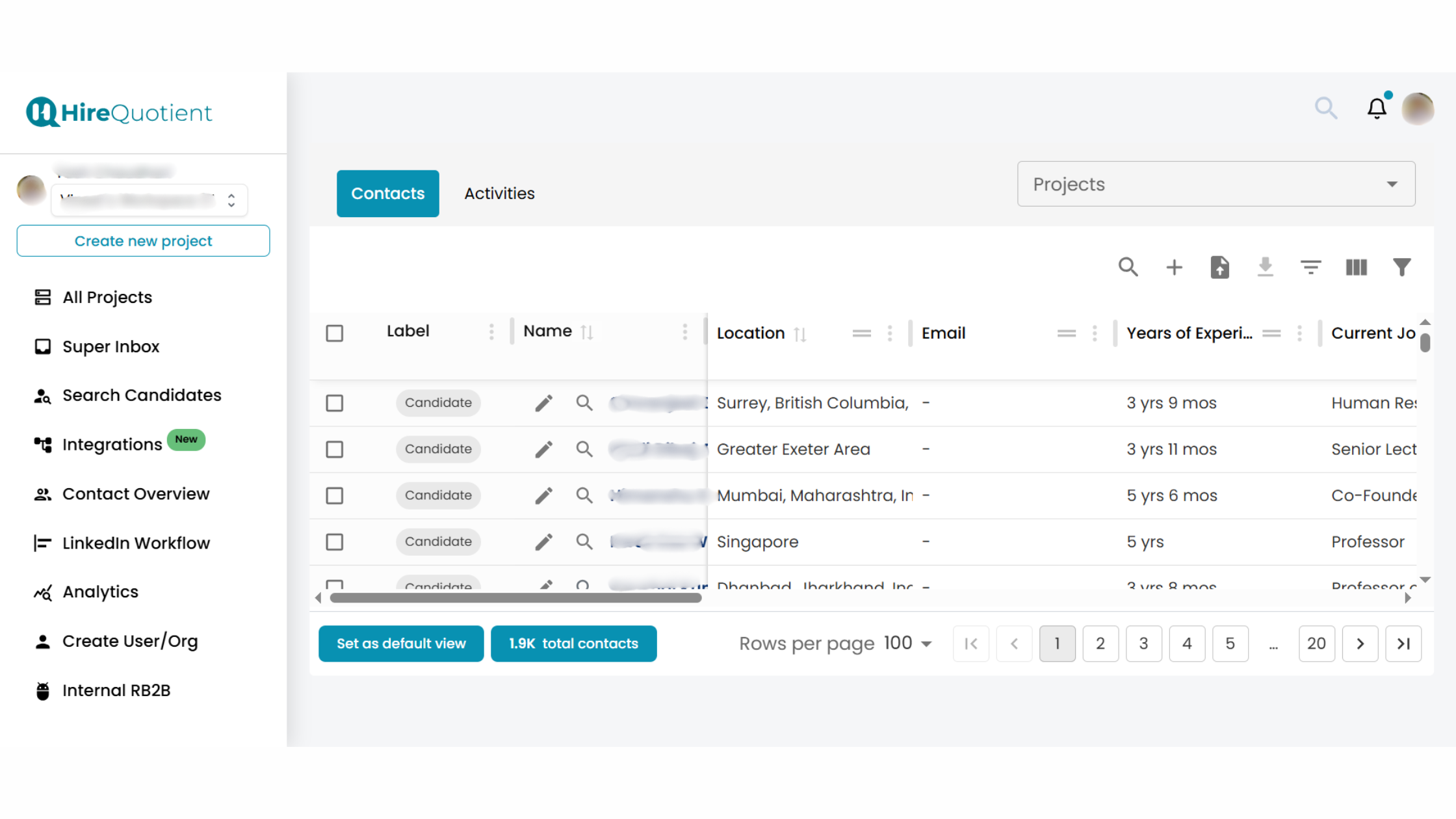

In the platform’s dashboard, recruiters can see:

- Total candidates sourced

- Number contacted

- Size of the actionable pool (high-quality matches for engagement)

This makes it easier to track performance and optimize outreach strategies in real-time.

3. Smart Engagement Through Generative AI

Recruiters often struggle with sending personalized outreach at scale. EasySource solves this by integrating generative AI technologies that auto-generate hyper-personalized messages based on candidate profiles. These messages are:

- Tailored to the candidate’s background and skills

- Sent across multiple platforms, including LinkedIn and email

- Tracked for performance insights (e.g., response rates)

This allows recruiters to achieve deeper candidate engagement without spending hours crafting individual messages.

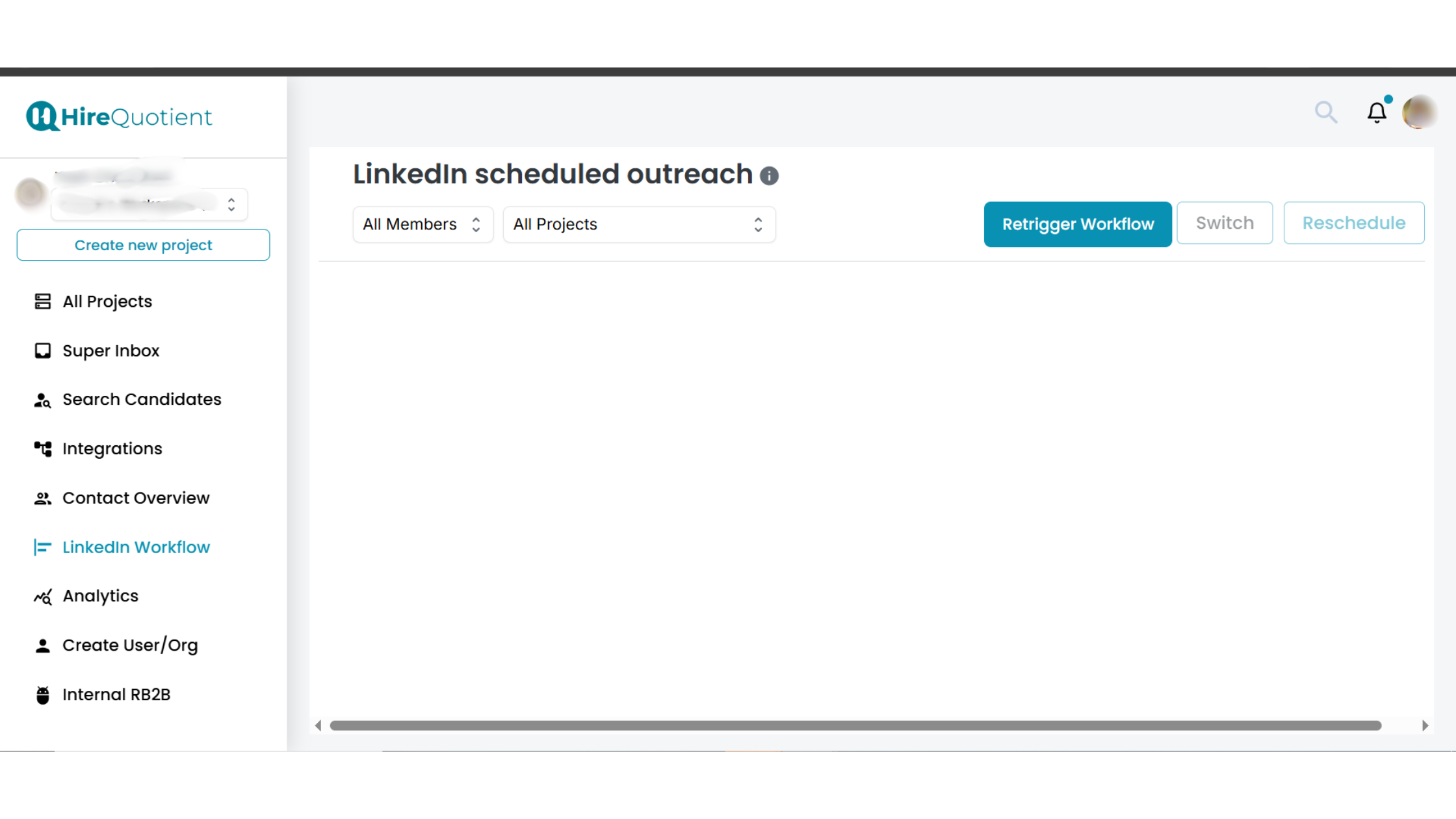

4. LinkedIn Workflow Integration

The platform seamlessly connects with LinkedIn via the LinkedIn Workflow tab in the sidebar. This means recruiters can:

- Amplify their LinkedIn search capabilities with AI assistance

- View, shortlist, and engage with candidates directly from the EasySource dashboard

- Manage entire workflows without needing to switch tabs or platforms

This deep integration ensures a smoother and more productive sourcing experience.

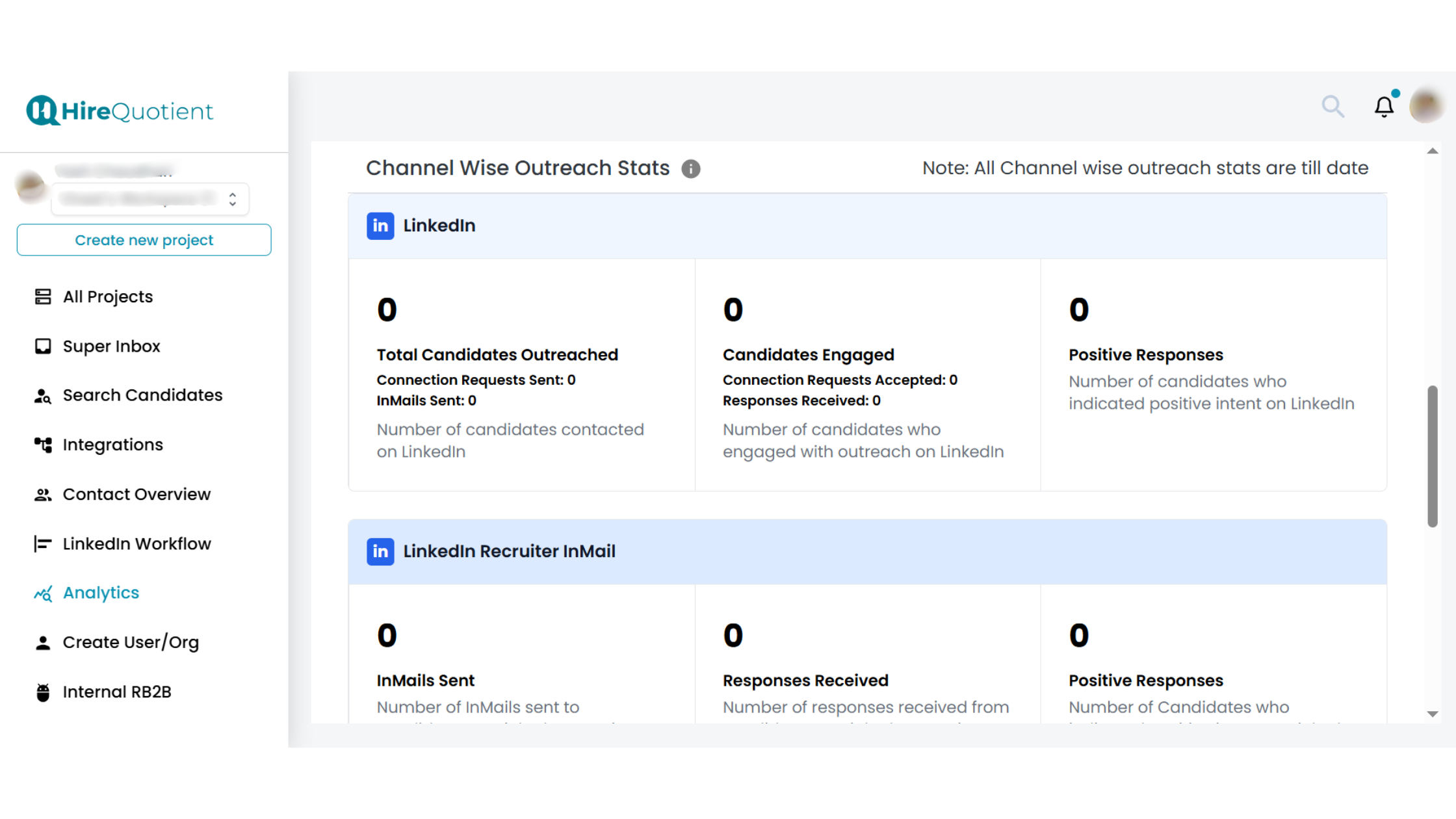

5. Real-Time Analytics and Reporting

With built-in Analytics tools, recruiters get a bird's-eye view of their sourcing effectiveness:

- How many candidates were added to a project

- How many were contacted

- Number of candidates who engaged with outreach on LinkedIn

- Number of candidates who indicated positive intent

Such insights empower data-driven recruiting decisions, making it easier to refine sourcing strategies for exempt roles.

EasySource is not just another sourcing tool—it’s a complete recruitment automation engine tailored for finding exempt talent efficiently. With AI-driven filters, generative AI messaging, deep LinkedIn integration, and real-time analytics, recruiters are equipped to handle high-volume sourcing with pinpoint accuracy and personalization.

Whether you’re hiring for a senior marketing role, a seasoned engineer, or a niche consultant, EasySource makes it effortless to discover and connect with top-tier exempt talent. Say goodbye to manual grunt work and hello to sourcing the smart way.

Conclusion

In conclusion, knowing which employees are excluded from overtime compensation is essential for keeping firms in line with federal regulations and averting legal action. For employee classification, the combination of job functions and wage requirements is critical. Recruiters and recruiting managers should know this information because it may have some impact on their firm's pay packages, legal requirements, and labor regulations.

One of the most important aspects of labor law compliance that companies need to be aware of is the designation of exempt personnel. It is crucial to make sure that workers are appropriately classified and that their job responsibilities meet the requirements of the Fair Labor Standards Act (FLSA).

Therefore, it's critical for hiring managers and recruiters to stay up to date on local and federal labor rules and to have thorough employment contracts and paperwork. Employers can establish a productive, legal, and equitable workplace by thoroughly comprehending exempt employee status and adopting a proactive approach to pay and benefits.

Authors

Soujanya Varada

As a technical content writer and social media strategist, Soujanya develops and manages strategies at HireQuotient. With strong technical background and years of experience in content management, she looks for opportunities to flourish in the digital space. Soujanya is also a dance fanatic and believes in spreading light!

Hire the best without stress

Ask us how

Never Miss The Updates

We cover all recruitment, talent analytics, L&D, DEI, pre-employment, candidate screening, and hiring tools. Join our force & subscribe now!

Stay On Top Of Everything In HR